The 7-Minute Rule for Custom Private Equity Asset Managers

Wiki Article

The Best Guide To Custom Private Equity Asset Managers

(PE): investing in companies that are not openly traded. About $11 (https://custom-private-equity-asset-managers-44593031.hubspotpagebuilder.com/custom-private-equity-asset-managers/unlocking-wealth-navigating-private-investment-opportunities-with-custom-private-equity-asset-managers). There may be a couple of points you do not understand concerning the sector.

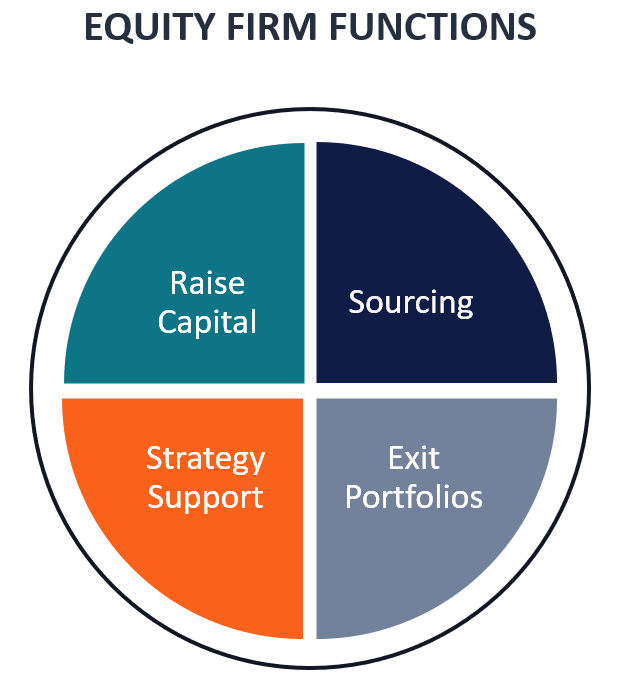

Partners at PE companies elevate funds and manage the money to generate beneficial returns for shareholders, generally with an financial investment horizon of between 4 and seven years. Personal equity firms have a variety of investment choices. Some are rigorous financiers or passive capitalists entirely reliant on management to expand the company and generate returns.

Since the ideal gravitate towards the larger offers, the center market is a dramatically underserved market. There are a lot more vendors than there are highly seasoned and well-positioned money experts with considerable purchaser networks and resources to handle an offer. The returns of exclusive equity are normally seen after a couple of years.

How Custom Private Equity Asset Managers can Save You Time, Stress, and Money.

Traveling listed below the radar of huge multinational companies, most of these little firms frequently give higher-quality customer care and/or specific niche product or services that are not being provided by the large corporations (https://wh8yd8agf3f.typeform.com/to/bDcW2xON). Such advantages bring in the passion of exclusive equity companies, as they possess the insights and smart to exploit such possibilities and take the firm to the following level

Exclusive equity capitalists need to have trustworthy, qualified, and trustworthy monitoring in position. A lot of managers at profile business are given equity and reward settlement frameworks that compensate them for striking their monetary targets. Such positioning of objectives is commonly required prior to a deal gets done. Personal equity chances are usually out of reach for individuals who can not spend millions of bucks, yet they should not be.

There are laws, such as restrictions on the accumulation amount of cash and on the number of non-accredited capitalists. The personal equity business draws in several of the most effective and brightest in business America, including top entertainers from Ton of money 500 firms and elite monitoring consulting companies. Law companies can also be hiring grounds for exclusive equity works with, as accountancy and lawful abilities are necessary to full offers, and transactions are highly demanded. https://cpequityamtx.creator-spring.com.

Excitement About Custom Private Equity Asset Managers

An additional disadvantage is the absence of liquidity; as soon as in a private equity transaction, it is difficult to leave or offer. There is a lack of flexibility. Private equity also features high charges. With funds under management currently in the trillions, exclusive equity firms have come to be appealing financial investment cars for wealthy people and establishments.

For years, the characteristics of exclusive equity have made the asset course an attractive recommendation for those that might get involved. Since access to exclusive equity is opening approximately even more individual financiers, the untapped possibility is becoming a fact. The question to take into consideration is: why should you spend? We'll start with the main arguments for investing in private equity: How and why exclusive equity returns have actually traditionally been greater than various other possessions on a number of degrees, Exactly how consisting of private equity in a portfolio impacts the risk-return profile, by helping to branch out against market and intermittent risk, After that, we will certainly lay out some key factors to consider and dangers for exclusive equity investors.

When it comes to presenting a new property right into a profile, the many fundamental consideration is the risk-return account of that possession. Historically, private equity has shown returns comparable to that of Emerging Market Equities and more than all other traditional asset courses. Its reasonably reduced volatility combined with its high returns creates an engaging risk-return account.

The smart Trick of Custom Private Equity Asset Managers That Nobody is Talking About

As a matter of fact, exclusive equity fund quartiles have the best variety of returns across all alternative asset courses - as you can see listed below. Method: Interior rate of return (IRR) spreads determined for funds within vintage years separately and then balanced out. Average IRR was computed bytaking the average of the mean IRR for funds within each vintage year.

The impact of adding private equity into a profile is - as constantly - dependent on the portfolio itself. A Pantheon study from 2015 recommended that consisting of exclusive equity in a portfolio of pure public equity can unlock 3.

On the various other hand, the most effective private equity firms have access to an even bigger swimming pool of unidentified chances that do not deal with the exact same scrutiny, along with the resources to do due diligence on them and identify which are worth purchasing (Private Asset Managers in Texas). Spending at the ground floor means greater risk, but also for the business that do prosper, the fund take advantage of higher returns

An Unbiased View of Custom Private Equity Asset Managers

Both public and private equity fund managers devote to spending a percent of the fund however there remains a well-trodden issue with lining up rate of interests for public equity fund monitoring: the 'principal-agent trouble'. When an investor (the 'principal') hires a public fund manager to take control of their funding (as an 'representative') they entrust control to the manager while retaining ownership of the properties.

look at this nowIn the instance of private equity, the General Companion does not simply make a monitoring fee. Personal equity funds additionally mitigate one more kind of principal-agent trouble.

A public equity capitalist ultimately desires one point - for the administration to increase the supply cost and/or pay out returns. The financier has little to no control over the decision. We showed over the amount of personal equity strategies - specifically bulk buyouts - take control of the operating of the business, guaranteeing that the long-lasting value of the firm precedes, rising the return on financial investment over the life of the fund.

Report this wiki page